The efforts of the Independent Insurance Agents and Brokers of SC (IIABSC or the Big “I”) along with the SC Department of Insurance (SCDOI) and the SC Wind and Hail Underwriting Association (SCWHUA) are paying benefits for coastal consumers. According to a study conducted by the staff at SCWHUA, it is losing business to the private sector.

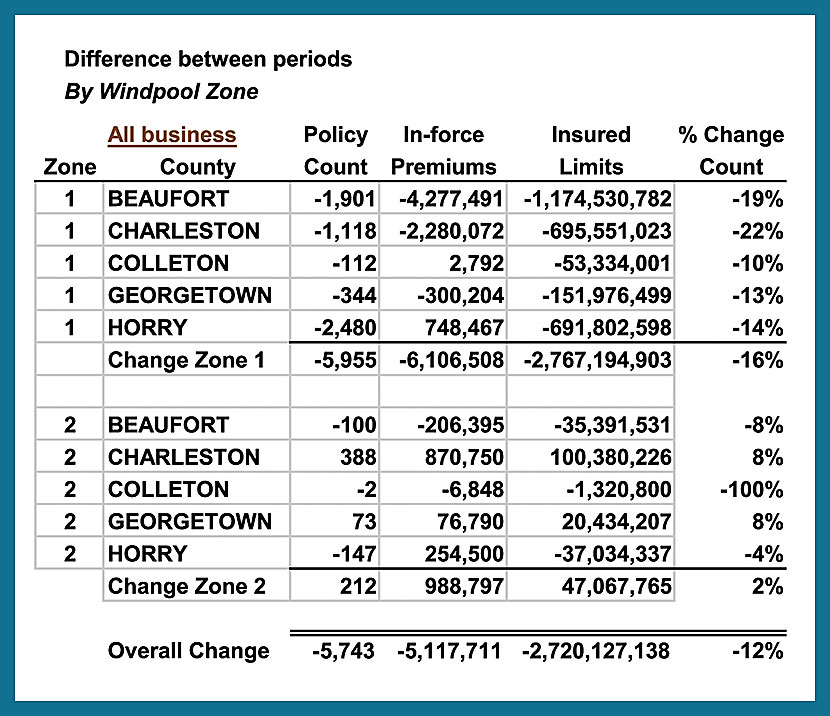

SCWHUA looked at their book of business on Feb. 15 of this year and compared it to that on Aug. 31, 2011, when it peaked. Almost two and a half years later significant decreases have occurred. The following chart illustrates the changes by zone and by county.

In Zone 1, SCWHUA has lost almost 6,000 policies. In-force liability is down $2.8 billion. When Hurricane Hugo hit South Carolina, the SCWHUA had a little more than 5,000 policies and $940 million in exposure.

From an exposure standpoint, we have ‘lost’ the wind pool three times.What is really amazing is that in Beaufort County and Charleston County, we have lost a total of over 3,000 policies. Each of these risks is located on a barrier island. We even have significant policy losses in Horry County.

While there have been slight decreases in Zone 2, growth in Charleston County has overshadowed the loss of policies in this particular zone. The difference in Zone 2 is because in areas of Charleston County, Zone 2, the Association is probably a little more price competitive than a residual market should be. In addition, we do have some direct writers that have extremely loyal clients that would rather be with the direct writer and the wind pool as opposed to another carrier that might offer them an alternative on the wind.

In discussions with SCWHUA staff, it was pointed out that the decrease in policy count is a net number. Over this same time period, it has lost close to 12,000 policies, but has replaced some of this business with 7,000 new business policies. Underwriting Manager David Leadbitter said, “We are not double-counting in this process. We looked at which policies we lost and did not come back in order to determine ‘lost’ business.”

The efforts by the Big “I” and others to recruit new insurers to the state as well as to work with existing markets to provide coastal insurance has contributed to the decrease in SCWHUA’s total policy count and in-force liability limits.

Since the passage of the Omnibus Act, the SCDOI has licensed 19 new companies to write coastal property insurance coverage. They include:

- Ironshore Insurance Ltd.

- Lancaster Company Ltd.

- Southern Fidelity Insurance Company

- Privilege Underwriters Reciprocal Exchange

- Fidelity Fire and Casualty Insurance Company

- Arial Reinsurance Company Ltd.

- Universal Property and Casualty Insurance Company

- American Federation Insurance Company

- North Lights Specialty Insurance Company

- Florida Peninsular Insurance Company

- St. Johns Insurance Company

- American Safety Insurance Company

- United Property and Casualty Insurance Company

- American Capital Assurance Corporation

- Preserver Insurance Company

- Lighthouse Property Insurance Company

- Centauri Specialty Insurance Company

- Intervoro Insurance Company

- U. S. Plate Glass Insurance Company

In a 2012 issue of Property Insurance Report, the editors talked about the positive changes taking place in South Carolina. They noted that individual companies are not having a significant impact on the coastal property market place. Yet at the same time, the collective group has had a positive cumulative effect.

Currently, there are several insurers going through the application process at the SCDOI. These companies are seeking permission to write coastal property insurance.

According to SCWHUA staff, it is a positive trend. Insurers are slowing entering the market place. The residual market is losing business. Consumers are finding they may have options available to them for their coastal property insurance needs. At the same time, SCWHUA is available to assist those experiencing difficulties in obtaining coverage.