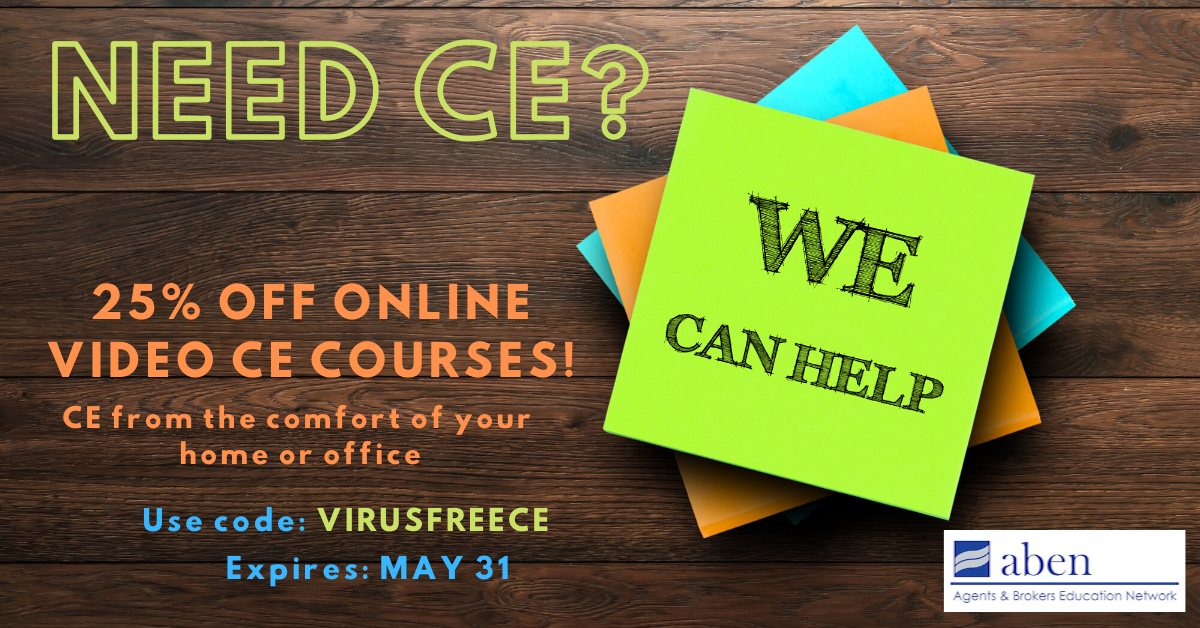

The following webcast courses have been added to IIABSC course catalog with Agents & Brokers Education Network (ABEN). They are available both on the calendar or on demand. Remember to use code VIRUSFREECE for 25% off between now and May 31.

Trusted Choice Annuity Suitability Course, 4 hrs. L&H

The Trusted Choice Annuity Suitability Course satisfies the 4-hour requirement for agents that are life insurance licensed that want to offer annuities. This course covers the demographic environment confronting retirees; the appropriate role of annuities in providing retirement income; types and characteristics of annuities; annuity tax considerations; and suitability and regulatory concerns.

Insuring Coastal Exposures,

3 hrs. P&C

Coastal exposures present unique challenges for insurance agents and carriers. This course will review some of those challenges in homeowners insurance, commercial property insurance, condominium coverages, business income, flood, and wind. Also discussed will be the particular E&O concerns for agents when insuring coastal exposures. Taught by Terry Tadlock.

Builders Risk and Contractors Equipment,

2 hrs. P&C

This course will discuss Builder’s Risk and Contractors Equipment coverages. A comparison of the completed value form and reporting form Builders Risk, property covered and not covered, causes of loss and valuation issues are examined. The discussion on Contractors Equipment examines the property covered and not covered, scheduled vs blanket coverage, exposures to loss and some common endorsements. Taught by Terry Tadlock.

Setting Business Income Limits,

1 hr. P&C

This course will show agents the factors needed to set the proper Business Income limits for their clients. The coinsurance method, Maximum Period of Indemnity, and Monthly Limit of Indemnity methods will be addressed. Taught by Terry Tadlock.

Claims Made Policies – The Most Dangerous Insurance Policies in our Industry,

1hr. P&C

This course will discuss the major differences in an occurrence verses a claims-made policy including the coverage triggers, the retroactive date and the extended reporting period. Also covered will be the need for claims-made and common policies today that are written on a claims-made basis. Taught by Greg Jones.

Lloyds – Marketplace to the World,

2 hrs. P&C

An in depth look at the history, structure, governance and performance of the world’s oldest insurance market. The presentation provides an overview of the global market and focuses on the US market with details on distribution and lines of business. Finally, it will provide insight into new and emerging risks and development of new classes of insurance. Taught by Rodney Smith.

Understanding and Managing the Two Largest Government Benefits: SS and Medicare,

3 hrs. L&H

The United States government provides various programs to us - two of the largest are Social Security and Medicare. The qualification rules for both are very specific. This three-hour webinar will review the various qualification rules and the complex, and potentially confusing benefits of each program. Additionally, there will be a review of the various insurance products that are available to the Medicare beneficiary that can fill the gaps and a discussion of various products and concepts the Social Security beneficiary can consider so as not to be 100% dependent on that program at retirement time.

Captives – What Are They and How Do They Work?,

1 hr. P&C

This course will examine captive insurance companies and how they function in the insurance marketplace. Discussion topics will include how captives are domiciled, why captives are formed, the different types of captives, what coverages captives usually provide and how captives can benefit independent insurance agents. Taught by John Dohn and Jeremy Colombik.